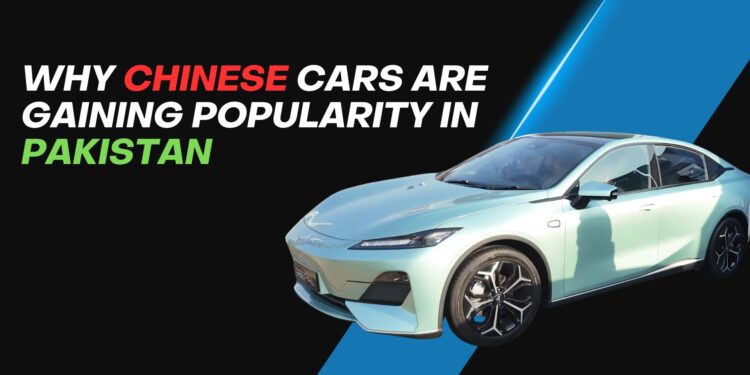

Islamabad— In a small but bustling showroom in Islamabad, Mohammad Zeb Mushtaq gestures toward a gleaming Changan Alsvin sedan. As Sales Manager at Changan Islamabad for the past four years, he’s witnessed firsthand the evolution of Pakistani consumers’ attitudes toward Chinese automobiles.

“If you compare Toyota or Honda, the difference between our full option sedan and theirs is almost 1.5 to 2 million rupees,” Mushtaq explains, highlighting the price advantage that has emerged as a key selling point for Chinese automotive products in Pakistan.

Shifting Gears in a Protected Market

The Pakistani automotive landscape has long been dominated by the “Big Three” Japanese manufacturers, Toyota, Honda, and Suzuki. For decades, these brands have enjoyed near-monopolistic conditions in a protected market with limited competition. But since 2021, Chinese automakers have accelerated their presence, introducing new alternatives that challenge the status quo with competitive pricing and feature-rich offerings.

Changan, which established its presence in Pakistan in January 2021, now offers vehicles across multiple segments including sedans, SUVs, MPVs, and commercial vehicles. Other Chinese brands making inroads include Haval, Chery, and DFSK, creating unprecedented competition in a formerly restricted market.

“Currently, the Chinese brands in the market include Haval, Chery Tigo Pro, and DFSK,” notes Mushtaq. “Otherwise, you have Korean products like Kia and Hyundai which also compete.”

Value Proposition: Feature-Rich at Lower Costs

The primary appeal of Chinese vehicles lies in their value proposition, offering advanced features at significantly lower price points compared to established Japanese brands.

“In our SUV segment, if we have the Oshan X7… if you go to Toyota, the Fortuner which is a similar-sized vehicle will cost you 2 crore almost, 1 crore 70 lakh rupees,” Mushtaq points out, highlighting the substantial price differential that attracts budget-conscious Pakistani consumers.

This price advantage comes at a crucial time when Pakistan’s economy faces significant challenges. The Pakistani Rupee has depreciated by nearly 79.24% against the US Dollar in just five years, from ₨155.66 per USD in January 2020 to ₨279.04 in January 2025. This dramatic devaluation has eroded purchasing power and made the affordability of Chinese vehicles increasingly attractive.

Challenging Perceptions of Quality

Despite their price advantage, Chinese automobiles initially faced skepticism regarding quality and durability, perceptions that brands like Changan are working to overcome.

“Actually, our perspective is limited,” Mushtaq observes about Pakistani consumers’ hesitation toward Chinese products. “If you consider the global market, Chinese products have reached everywhere. The Chinese make products of every quality. If you ask for an A-level product, they will give you an A-level product.”

These quality concerns weren’t entirely unfounded. Mushtaq acknowledges early issues with Changan vehicles.

“When our car was launched in 2021, at that time, there was an issue with its paint quality at the beginning. Many customers had complaints, and later the company resolved that issue. After that, there was a generator issue. That has been resolved as well,” said Mushtaq.

This incremental improvement approach appears to be working. Chinese brands are gaining acceptance in the market as they demonstrate their commitment to addressing quality concerns and continuously enhancing their products.

The Resale Value Equation

In Pakistan’s unique automotive ecosystem, cars aren’t merely transportation, they’re investments. Unlike most global markets where vehicles depreciate over time, Pakistani cars often appreciate in value, particularly when measured in the local currency.

A Toyota Corolla XLI purchased in 2020 for PKR 2,599,000 could sell for approximately PKR 4 million in 2025, a nominal appreciation of over 50%. Similarly, Changan’s Alsvin Lumiere sedan, which launched at PKR 2.9 million in 2021, could fetch around PKR 3.5 million in used market in 2025.

This appreciation, however, is largely illusory when considered in real terms. It primarily reflects currency depreciation and inflation rather than genuine value enhancement. Nevertheless, this phenomenon has established cars as “stores of value” in Pakistani consumer culture, similar to gold or real estate.

This traditional view presents a significant challenge for Chinese newcomers. As Mushtaq explains: “If you compare with Toyota, if a Toyota car sells in 10 days, then Changan takes a maximum of 25 to 30 days to sell as a used car.”

This liquidity differential reflects the entrenched trust in established brands and remains a key consideration for Pakistani buyers evaluating Chinese alternatives. The big three Japanese brands enjoy widespread acceptance in the used car market, stemming from decades of reputation building, an advantage that newer Chinese entrants are still working to achieve.

After-Sales: The Warranty Weapon

To combat concerns about reliability and build confidence in their products, Chinese manufacturers have deployed aggressive warranty policies that exceed industry standards.

“In our SUV products, there is a warranty of 150,000 kilometers or 5 years. And the same in Alsvin also, same five years or 150,000 kilometers warranty,” Mushtaq explains. This compares favorably to the typical three-year warranties offered by established competitors.

However, parts availability and cost remain concerns. While warranty-covered replacements are handled within 4 to 10 days according to Mushtaq, the lack of local manufacturing for spare parts means higher costs for consumers.

“Its vendor is not local yet, and only A+ quality imported parts are available,” Mushtaq admits. “If parts are sourced by the company. It becomes a bit costly.”

This reliance on imported parts creates a disadvantage compared to the Japanese brands, which benefit from decades of local supplier development and aftermarket options that offer varied price points for consumers.

Market Impact and Competitive Response

The entry of Chinese brands has had ripple effects throughout Pakistan’s automotive sector. Their feature-rich offerings have raised consumer expectations and forced established players to enhance their own products to remain competitive.

By introducing advanced technology packages at lower price points, Chinese manufacturers have effectively reset the value equation in the Pakistani market. Features once considered premium extras, like sunroofs, touchscreen infotainment systems, advanced safety technology, are becoming standard expectations even at lower price points.

“Take the Honda City, for example, you don’t even have a sunroof in it. The full variant comes at 6 million rupees,” highlights Mushtaq, pointing to the feature disparity that has become a key selling point for Chinese alternatives.

This competitive pressure has begun driving product improvements across the industry, ultimately benefiting Pakistani consumers who now have more choices at various price points.

Future Trajectory and Market Potential

Despite making significant inroads, Chinese auto brands in Pakistan still face the challenge of establishing long-term credibility and overcoming entrenched preferences. However, their trajectory suggests continued growth potential.

“In the next 5 to 6 years, you will see further that Changan is moving very far ahead in the Pakistani market,” predicts Mushtaq, confident about the brand’s future prospects.

Several factors support this optimistic outlook. Pakistan’s large population of over 220 million, coupled with low motorization rates, suggests significant room for market expansion. Additionally, the economic challenges facing the country make Chinese brands’ value proposition increasingly relevant to cost-conscious consumers.

The introduction of electric vehicles also represents a potential advantage for Chinese manufacturers, who lead globally in EV production and technology. As Mushtaq notes: “We just launched the electric vehicle, if you go to Tesla and take the same thing, you get it for 5 to 6 crore rupees. and for the same quality, if you get a Chinese product… it comes for 1.5 crore rupees.”

This EV expertise could provide Chinese brands with a strategic advantage as Pakistan, like many countries, gradually transitions toward electrification.

Investment Perspective in Automobile Culture

Pakistan’s unique automotive market dynamics have created a culture where cars are viewed as investments rather than depreciating assets. The persistent economic instability and dramatic currency fluctuations have pushed consumers toward tangible assets that preserve value better than rapidly devaluing cash holdings. In a country where the rupee has lost nearly 80% of its value against the dollar in just five years, vehicles represent a relatively secure store of value.

The protectionist market conditions and limited supply have historically kept vehicle prices high and rising, further reinforcing the perception of cars as appreciating assets. When combined with the typically long waiting periods for new vehicles, often stretching months due to import restrictions and production limitations, immediately available used cars command premium values, creating a secondary market that frequently defies global depreciation norms.

Brand reputation and reliability perceptions significantly influence these resale values. The established Japanese brands, with their decades of presence and proven durability, command the highest premiums in this investment-oriented market. This phenomenon is starkly illustrated by the Suzuki Alto, which has appreciated approximately 60% over four years, from a base price of PKR 13.5 lakh in 2020 to PKR 22-23 lakh by 2024, demonstrating how certain vehicles have outperformed many traditional investments in nominal terms.

This investment mindset creates both challenges and opportunities for Chinese brands entering the market. While they must overcome skepticism about long-term value retention, their lower entry prices potentially allow for greater percentage appreciation if they successfully establish market acceptance. For brands like Changan, convincing Pakistani consumers that their vehicles represent not just transportation but a viable investment alternative to the established Japanese options remains a crucial hurdle to widespread adoption.

Consumer Perspectives Evolving

The narrative around Chinese automobiles in Pakistan continues to evolve. Initial skepticism is gradually giving way to pragmatic consideration as more consumers experience these vehicles firsthand and weigh their advantages against traditional options.

The value proposition, more features at lower prices, remains compelling, particularly in Pakistan’s challenging economic environment. But concerns about resale value, parts availability, and long-term reliability persist.

As Chinese manufacturers address these concerns through improved product quality, expanded dealer networks, and strengthened after-sales support, their market position is likely to strengthen.

Market Outlook and Implications

The entry of Chinese auto brands has fundamentally altered Pakistan’s automotive landscape. What was once a highly concentrated market dominated by a few Japanese manufacturers has transformed into a more diverse ecosystem with expanded consumer choices across multiple price points.

This increased competition is driving innovation, improving feature offerings, and potentially creating downward pressure on prices, all benefiting Pakistani consumers. It may also accelerate localization efforts as manufacturers seek cost advantages through domestic production and sourcing.

For established players, the Chinese challenge necessitates strategy adjustments. While their brand equity and resale advantage remain strong, they can no longer rely solely on these factors without addressing the feature and price gaps highlighted by Chinese competitors.

The trajectory of Chinese auto brands in other emerging markets suggests Pakistan may be following a similar path, where initial skepticism gradually gives way to mainstream acceptance as product quality improves and market presence expands.

“So, with time, improvement comes in the car because we’ve only been in the market for four years,” says Mushtaq, highlighting the ongoing evolution of Chinese offerings in the Pakistani market.

This evolution represents not just a business competition but a broader transformation in how Pakistani consumers perceive automotive value and brand hierarchies, a shift that continues to accelerate as economic realities push more buyers to consider alternatives to traditional choices.

As these Chinese brands continue investing in product development, after-sales infrastructure, and market education, they appear positioned to establish a permanent and growing presence in Pakistan’s automotive landscape, carving new roads in both market share and consumer perception.